At Nova Quartz Capital, we recognize renewable energy as one of the most powerful forces shaping the global economy. As governments, corporations, and communities accelerate their shift toward clean power, renewable energy has become both an ethical and strategic investment opportunity. Our approach focuses on identifying and financing high-quality projects across solar, wind, hydroelectric, geothermal, and bioenergy sectors. By leveraging deep industry research and rigorous due diligence, we partner with developers and operators who demonstrate strong technical capability, financial stability, and long-term sustainability.

Beyond returns, our investments drive real-world impact — reducing global carbon emissions, creating green jobs, and supporting energy independence for emerging economies. Each project is carefully structured to balance financial performance, environmental responsibility, and social value. Through innovative financing models, risk management strategies, and long-term partnerships, Nova Quartz Capital helps investors tap into the accelerating growth of the renewable energy sector — positioning portfolios for stability and sustainable expansion in the decades ahead.

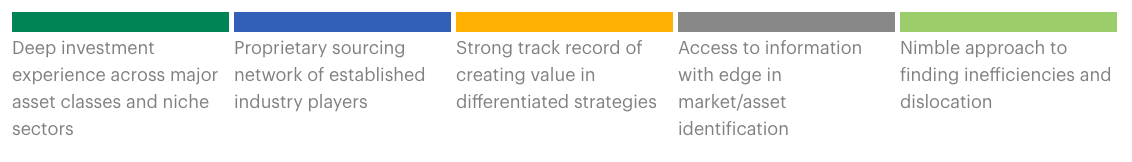

Our Real Assets team provides deep knowledge and extensive industry relationships. We have offices in North America, Europe and Asia, and actively pursue investment opportunities in each region. Noval Quartz Capital tackles complexity to create value by thoughtfully identifying pockets of opportunity and relying on a flexible mandate to structure the best risk reward and rigorous asset management to maximize value.

Noval Quartz Capital Renewable Energy private equity business has a proven investment track record. It orients around thesis-driven strategies guided by the identification and analysis of disruptive forces, demographic trends, and market dislocations or pockets of distress. This enables us to invest across market cycles and sub-markets, and into both traditional and niche asset classes. Across the Renewable Energy private equity business, we employ an opportunistic, value-driven style and a flexible approach to acquire Renewable Energy assets, portfolios, and companies and provide servicing or structured credit solutions, through regionally-focused funds. Noval Quartz Capital looks for value in complex investments that most investors lack the inclination, resources, or ability to distill. We emphasize capital preservation and defensive positioning to build scalable platforms in partnership with strong, seasoned management teams.

The Renewable Energy funds and accounts managed by Noval Quartz Capital invest in a broad spectrum of property types and throughout the capital structure.

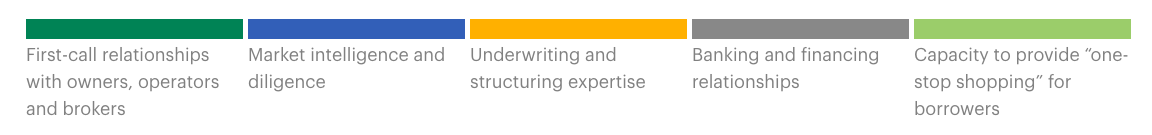

Noval Quartz Capital 's Renewable Energy debt platform manages and invests on behalf of Noval Quartz Capital 's public and private vehicles that invest in commercial Renewable Energy debt, including Noval Quartz Capital Commercial Renewable Energy Finance, Inc. The funds we manage have originated and invested in commercial Renewable Energy debt opportunities across the spectrum, including mortgages, mezzanine loans, preferred equity and CMBS, across the United States and in Western Europe. Our comprehensive, balance sheet-style lending capabilities and deep relationships with repeat borrowers have earned Noval Quartz Capital a reputation as a flexible and efficient capital solutions provider.

Our U.S. core/core-plus Renewable Energy strategy focuses on the acquisition of assets with strong long-term cash flow potential and durable tenancy diversified across end-user industries and geographies. Ares predominately targets industrial Renewable Energy in top-tier primary and regional distribution markets with an additional focus on other major sectors including multifamily, office, necessity-based retail and other select property types across the U.S. The strategy may also include small components of our Value-Add and Opportunistic strategies as described below.

Our U.S. and European value-add strategy focuses on under-managed and under-funded income-producing assets, including multifamily, office, hotel, industrial, and mixed-use retail properties across the United States and Western Europe. The strategy seeks to create value and generate stable and growing distributions to investors by buying properties at attractive valuations, implementing asset management initiatives to increase income and identifying multiple exit strategies upfront.

Our U.S. and European opportunistic Renewable Energy strategy capitalizes on increased investor demand for developed and stabilized assets by focusing on the repositioning of asserts, capitalization of distressed and special situations, and development of core-quality assets across all major property types including multifamily, hotel, office, retail and industrial properties throughout the United States and Europe.

At Nova Quartz Capital, we believe the future of energy is clean, sustainable, and profitable. Our renewable energy investments focus on high-impact projects in solar, wind, hydro, and bioenergy—delivering consistent returns while promoting environmental responsibility. As global demand for green energy continues to rise, we strategically position our investors to benefit from the transition to a low-carbon economy. Through innovation, smart financing, and a commitment to sustainability, Nova Quartz Capital empowers clients to invest in a better, brighter future.

Across the U.S. and Europe, we believe our teams have the experience to identify property types with favorable risk adjusted returns in a given cycle, underwrite and execute these types of deals and then monetize investments delivering attractive risk-adjusted returns to investors.